Term life insurance protects for a defined period, usually 5 to 30 years. Among these options, 20-year term life policies specifically strike an ideal balance of affordability and long-term coverage. This guide delves into the nuances of such policies, comparing different offerings, to equip you with informed decision-making skills.

Policy Features and Coverage

Comparing 20-year term life insurance policies requires an understanding of the features and coverage provided by each policy. Most offer a consistent death benefit throughout the term. Moreover, some policies present options for riders such as accelerated death benefits or premium waiver riders. Ensure that you select a policy aligning with your needs by comprehending the specific coverage details.

Often, term life insurance policies offer more than just the death benefit; they provide additional advantages. These can encompass living benefits such as riders for terminal illness or chronic conditions. If diagnosed with a qualifying condition, policyholders gain access to part of their death benefit. Comprehending these supplementary features enhances financial security and instills peace of mind, both critical components in effective insurance planning.

- Examine the Fine Print: Pay attention to any exclusions or limitations within the policy's coverage to ensure you fully understand what is and isn't covered.

- Consider Future Needs: Assess whether the policy offers options for converting to permanent life insurance or extending coverage beyond the initial term if needed.

Premiums and Affordability

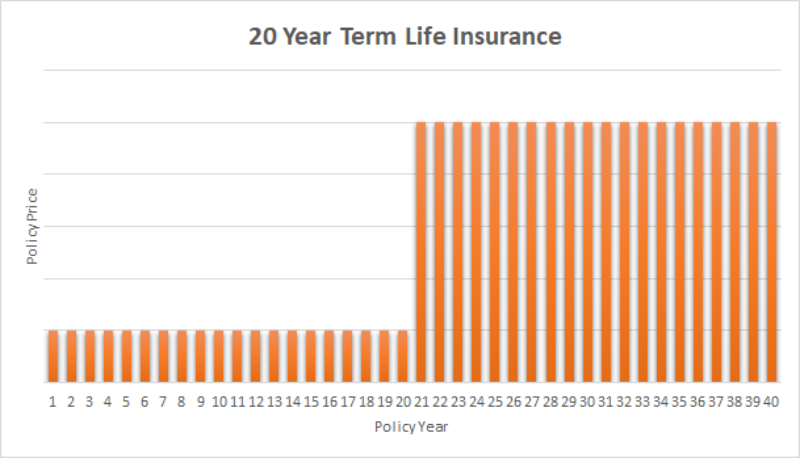

The affordability of premiums stands as a primary consideration in selecting a 20-year term life insurance policy, factors like age, health status, and coverage amount can significantly vary these financial commitments. To accurately compare premium rates, you must procure quotes from multiple insurance providers. This ensures thorough market examination for your best possible deal. Consider, additionally, whether are the premiums fixed or undergo changes over the term of the policy.

Affordability remains paramount. However, one must also critically evaluate the long-term implications of premium payments. Certain policies might lure with their lower initial premiums yet harbor steeper rate escalations over time. By thoroughly assessing and scrutinizing the policy's overall cost throughout its term, you are equipped to make an informed decision. This is a decision that could potentially save you substantial financial strain in future years.

- Assess Rate Guarantee Period: Check how long the premium rates are guaranteed to remain unchanged to avoid unexpected increases.

- Explore Payment Options: Inquire about flexible payment options, such as annual, semi-annual, or monthly premiums, to find a payment schedule that fits your budget.

Underwriting Process

Assessing the applicant's risk profile to determine eligibility and premium rates, underwriters engage in a meticulous process for 20-year term life insurance policies. They consider factors such as age, health history, lifestyle habits including smoking, exercise routines or hazardous activities, and family medical history during this vital underwriting phase. You can prepare yourself for any potential medical exams or inquiries required by your insurance provider, simply through understanding the underwriting process.

Insurance companies, in the underwriting process, might request an applicant's medical records; conduct interviews, or even require a medical examination, all to accurately evaluate their health status. Applicants must provide precise and comprehensive information during this phase. Doing so ensures the validity of the policy and forestalls potential future issues with claims.

- Gather Necessary Documentation: Prepare any medical records or information requested by the insurer to streamline the underwriting process.

- Be Transparent: Disclose all relevant information truthfully and accurately to avoid complications or disputes during underwriting.

Financial Strength and Reputation

Compare insurance providers by considering the financial strength and reputation of each company. Focus on insurers with high ratings from independent rating agencies. This indicates their capacity to fulfill financial obligations. Furthermore, delve into customer reviews and complaints as they will provide a gauge for measuring the level of service quality offered by each insurer. This is crucial in assessing overall customer satisfaction towards financial stability.

The company's financial stability stands as a critical element. It guarantees the insurer's ability to honor its commitments, specifically, claim payouts. Further than this, an exemplary reputation underpins not only dependable service but also equitable transactions with policyholders. Opting for an insurer of noteworthy repute and robust fiscal health yields supplementary assurance, a bonus that fosters tranquility within the mind.

- Check Ratings and Rankings: Review ratings from agencies like AM Best, Standard & Poor's, or Moody's to assess the insurer's financial strength and stability.

- Research Customer Feedback: Look for testimonials and reviews from policyholders to gauge their experiences with the insurer's claims process and customer service.

Flexibility and Customization Options

When comparing 20-year term life insurance policies, one must consider the essential factors of flexibility and customization options. Certain insurers provide a flexible approach to policy terms, enabling policyholders to modify their coverage or convert it into permanent life insurance as per evolving needs over time. Furthermore, explore the possibilities for adding or removing riders. These can be instrumental in tailoring your policy precisely to meet specific requirements.

The ability to customize your policy, adjust coverage amounts, add riders for enhanced protection, or even convert to a different type of insurance plan ensures that it aligns precisely with your evolving needs and circumstances. Flexibility not only allows you greater control over the terms and conditions within your plan. It also provides an invaluable peace of mind knowing you've tailored it specifically for yourself.

- Evaluate Conversion Options: Understand the conversion privileges offered by the policy, including the types of permanent life insurance available for conversion and any associated fees.

- Review Rider Options: Explore available riders such as accidental death benefit riders or child term riders to enhance your policy's coverage based on your individual needs.

Customer Service and Support

Finally, consider the level of customer service and support provided by each insurance provider. Reliable customer service is crucial for addressing any questions or concerns you may have throughout the policy term. Look for insurers with responsive customer support channels, such as phone, email, or online chat, to ensure that assistance is readily available when needed.

Prompt and helpful customer service can make a significant difference in your overall experience as a policyholder. From initial inquiries to claims processing and policy management, responsive support ensures that you receive timely assistance and guidance whenever required.

- Accessibility and Availability: Confirm the accessibility of customer support channels, including hours of operation and availability on weekends or holidays.

- Claims Handling Reputation: Research the insurer's reputation for claims processing efficiency and fairness in handling policyholder claims.

Bottomline

In conclusion, comparing 20-year term life insurance policies involves evaluating various factors such as coverage, premiums, underwriting process, financial strength, flexibility, and customer service. By conducting thorough research and obtaining quotes from multiple insurers, you can select a policy that offers the best combination of coverage and affordability to meet your needs and provide financial security for your loved ones.